Wilfred Murungi had worked in DR Congo, selling cigarettes in dollars on the bonnet of an old Land Rover. The returns were crazy

By GW Ngari

Editor-at-Large

The First Law of Millions states that “every millionaire creates wealth at somebody else’s expense.” This is the second of a five part series Undercover will run on the 20 commonest ways millions have been, are being made, and will be made in Kenya and elsewhere. Here goes…

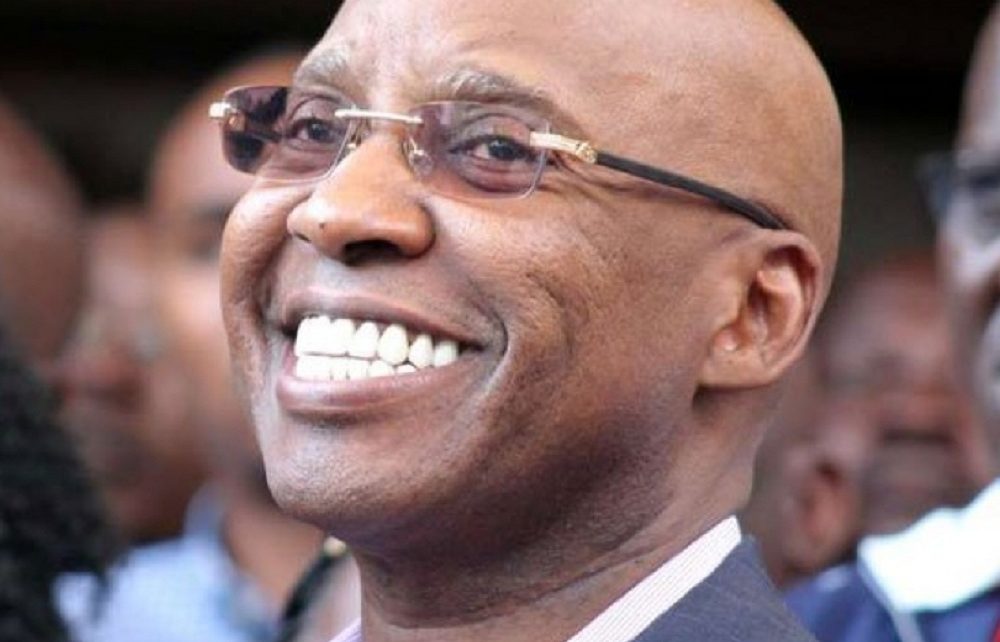

5. Business spin-offs: Think Wilfred Murungi and Mastermind Tobacco

Business spinoffs are mostly founded on leaving a giant company and expanding on a slightly different tangent. Like Edwin Dande and Cytonn above. Or the late Wilfred Murungi and Mastermind Tobacco, makers of Supermatch and Rocket brands.

The man nicknamed ‘Master’ previously worked for BAT Kenya as an engineer before seeing an opportunity in the lower end of the cigarette butt, the rural and peri-urban coughers. He had worked in DR Congo, selling cigarettes in dollars on the bonnet of an old Land Rover. The returns were crazy.

When BAT Congo then Zaire was selling its manufacturing equipment, he bid, dismantled the machinery and transported it to Kenya to found Mastermind Tobacco, triggering a turf war with BAT Kenya. But he still managed to corner a 16 percent market share according to Tobaccotactics.org, making Mastermind Kenya’s second largest cigarette maker but which had tax wars with KRA by the time of his death.

6. Deals & Wheeler-dealers: No Kenyan made Sh2 billion so casually!

Without capital, he also bought Bank of America for Sh60 million in 1985 and whose shares he offloaded to among others; the Kenyatta family to form Commercial Bank of Africa, now NCBA, Kenya’s third largest bank by assets. In Merali’s stable are also Sameer Africa, H. Young & Co., Eveready, Ryce Motors, Ryce Engineering, Sameer Industrial Park, Sameer Agriculture & Livestock, Yansam Motors all with an annual turnover of over Sh100 billion.

When it comes to deal making, few Kenyans can hold a candle to acquisition artist, Naushad Merali, the billionaire businessman who made the most amount of dough in the shortest time than anyone else since Kenya’s independence in 1963.

In under two hours in March 2004, the founder of listed firm Sameer Group, pocketed an eye watering Sh2 billion via selling shares of mobile phone operator Kencell Communications in Kenya to Celtel International then owned by Sudanese-born British billionaire Mo Ibrahim.

It so happened that 60 percent of Kencell was owned by French giant Vivendi Telecommunications International, the other 40 percent by Merali.

Jimi Wanjigi’s ‘facilitation fee’ accounts for a flat in London’s Park Lane, a massive mansion on five acres along 44 Muthaiga Road

Vivendi voiced intention to cede their Kenyan operations to Merali who held the pre-emptive rights to the 60 percent stake in case of a sale. Vivendi had South African telco giant MTN as buyers, but Merali had other ideas. He exercised his pre-emptive rights by buying the 60 percent stake for Sh1.6 billion loaned to him by Mo Ibrahim.

So that day in March, Merali acquired the stake via Sameer BV. That made him 100 percent owner of Kencell. He then rushed to another room where Celtel executives were waiting and offloaded 80 percent stake for Sh1.8 billion. No other Kenyan had made Sh2 billion so casually! …as did his lawyers.

That was not the first deal from which Merali was making super profits

When Celtel sold the business to Dubai based Zain Group, Merali offloaded 15 percent of his shares for Sh5.3 billion in 2009. Three years later, he sold the remaining 5 percent to India’s Bharti Airtel for Sh738 million-making Sh8 billion from his Kencel stake over eight years!

That was not the first deal from which Merali was making super profits. In 2000, he bought 75 percent of East African Cables for Sh105 million from Britain’s Delta Electric who were exiting the local market. Merali later sold the stake to Trans Century for 230 million in 2004, making Sh127 million profit!

7. Stealing: Start a bank, rob depositors like Janmohamed

The best way of stealing money is going to where it’s kept-the bank. But it is sometimes easier and safer to start a bank-then rob depositors from the comfort of your swivel chair at the corner office.

That was what Abdulmalek Janmohammed did: he helped turn a hire purchase outfit into Imperial Bank from 1992 before fraudulently salting away Sh38 billion in 13 years via ‘creative accounting.’ It was one of the most elaborate bank heists in Kenya’s history which was discovered after he died of heart attack at 56 in 2015.

One consequence is being caught as all those serving time at Kamiti attest

Though Abdulmalek owned 12.5 percent of Imperial bank, he had three different books of accounts: the real one showing his swindling ways, a second for the board of Imperial Bank and a third to the Central Bank of Kenya, the regulator. He kept the first.

The only consequence of stealing is being caught as some serving time at Kamiti Maximum Prison can tell you. But alas! Janmohammed was arrested by a heart attack, escaping the cooler.

8. Gaps in the market: Rose Kimotho and Kameme FM

You must notice that the demand is latent and blatant then lung for the kill

In filling gaps in the market, the future millionaire must possess one, instinct for the Main Chance. Two, choose a soft target, a market where demand is already heavy or where existing suppliers are panting behind the pace of unmistakable change. Third, aim for a sector of massive spending.

Among those who answered the calling was Rose Kimotho who quit McCann Erickson Kenya after realizing she had reached the dead end career speaking. The years she spent in advertising revealed there was a gap in reaching rural populations with advertising. There was a gap. She founded Regional Reach Ltd which showed films while running adverts in rural shopping centres.

Even as people laughed, it shortly became a market leader. Seeing there was no 24 hour news channel in Kenya, Kimotho founded K24 in 2007 and which she later sold alongside Kameme FM to the Kenyatta family for an undisclosed sum. Both are now part of Mediamax Network Ltd. Kimotho now runs Three Stones Ltd, owners of Three Stones TV and three other Kikuyu vernacular digital stations. But she proved that in exploiting gaps in the market, one must notice that the demand is latent and blatant then lung for the kill.

In Part III next Sunday: Securing wealth from arithmetic progression, professions, pyramid schemes and resurrecting dead companies