Keep emotions out of business, save that only for your wife

By Undercover Reporter

He made the most money of any Kenyan in the shortest time since independence: Sh2 billion in two hours, the stuff of fables. With no background in agriculture, he bought a multibillion agricultural company from a stranger-without seeing it- during a flight from Nairobi to London. He also signed to buy a Sh60 million bank with Sh600 in his pocket.

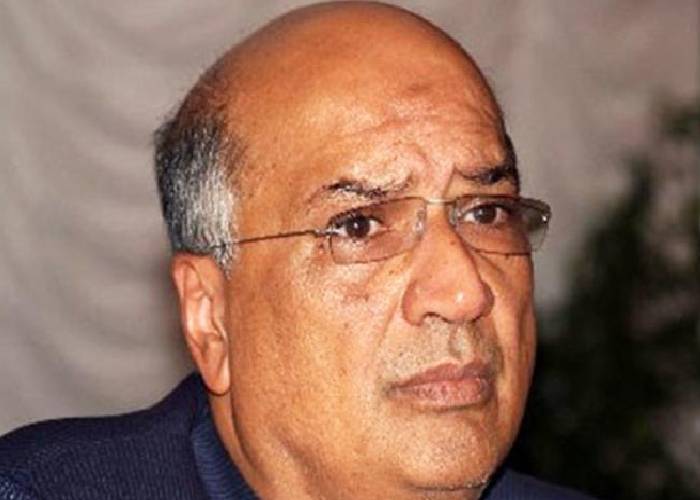

Naushad Merali, who died this Saturday at the Nairobi Hospital of undisclosed causes, was a shrewd acquisition artist of the blood, one who bought and resurrected dying companies, did business with presidents, their wives and sons.

How did Merali, a finance clerk at a motor dealership, bake a Sh40 billion bread with properties in London and Dubai; the hydra of business tentacles touching real estate, property, IT, insurance, transport, auto-dealership, energy, construction, manufacturing and large-scale agriculture raking in over Sh100 billion in annual turnover under the Sameer Group?

Forbes Africa ranked him Africa’s 39th richest person eight years ago for his Sh40 billion fortune

Merali bought businesses not to run them, but to make money: “keep emotions out of business, save that only for your wife” he said of his forays into buyouts before buy outs became fashionable.

The business for which he would later sing financial Hosannas was buying Ryce Motors from Frank Ryce in 1975. Merali, 24, was the accountant. Ryce was repairing to his native Germany and had a Sh600, 000 asking price. Merali showed interest but only if Frank could trouser a Sh200, 000 down payment. Frank agreed.

Ryce Motors had an account at Bank of America where Merali was known. He borrowed Sh200, 000 and bought Ryce Motors as “the company had a lot of potential and never once did I doubt the decision I had made,” he told Forbes Africa which ranked him Africa’s 39th richest eight years ago.

Mama Ngina and his sons Uhuru and Muhoho’s stake valued at over Sh15 billion!

Ryce Motors morphed into Ryce East Africa and Ryce Engineering, an energy concern. In a twist of fate, Merali would later buy Bank of America 10 years later. It was renamed Commercial Bank of Africa (CBA), which merged with NIC to form NCBA. “I signed a deal of Sh60 million but believe me, I only had Sh600 in my pocket and had 90 days to complete it” he recalled of his entry into finance. “A family friend even asked my wife to have my mental status checked.”

Merali-the ‘Seer of Sameer’ has been in banking with the Kenyattas-whom he invited as shareholders when he acquired Bank of America, the biggest local deal of 1985. After the merger, NCBA is Kenya’s third largest by assets with the Kenyattas as the largest shareholders-with Former First Lady Mama Ngina and his sons Uhuru and Muhoho’s stake valued at over Sh15 billion!

Money goes to where money is and more business comes via intermarriages

With the Moi family, Merali did business via proxies: Dr James McFie is both a director at Merali’s Sasini Tea & Coffee and Standard Group where the Moi’s hold a suffocating 90 percent stake with Moi’s former business henchman Joshua Kulei.

When Merali bought Sasini Mweiga Estate in Nyeri County, the seller was the late Charles Gathuri Mwangi, President Mwai Kibaki’s proxy in real estate and agriculture ventures besides both being the largest shareholders in the now troubled Deacons East Africa-which Gathuri founded.

Money goes to where money is and more business comes via intermarriages. Sameer Merali married the late Daisy Kamani, daughter of Deepak Kamani, fellow billionaire family-who introduced the Mahindra car in Kenya under the Kamsons Group (short for Kamani and sons).

When it came to making deals, Merali had that X-Factor that is disguised as instinct, foresight, gut feeling

But granted, when it came to making deals, Merali had that X-Factor and few Kenyans can hold a candle to the man who pocketed Sh2 billion in two hours in March 2004-through selling shares of mobile phone operator Kencell Communications to Celtel International. French giant Vivendi, held a 60 percent stake in Kencell while Merali had the other 40 percent.

Vivendi were exiting Kenya and Merali held the pre-emptive rights to the 60 percent stake. Pre-emptive rights give one shareholder a first right to the other’s shares in case of a sale.

Vivendi gave Merali 15 days to raise Sh25 billion. But assuming he would not hack the quid, asked South Africa’s MTN to be on standby. But Merali had other ideas. He bargained and Vivendi lowered the offer to Sh23 billion.

Merali sold Mo Ibrahim a company he bought with money had loaned him

The deal between Merali, Vivendi and Celtel took place at Sameer Group headquarters at 49 Riverside Drive. Vivendi and Merali’s lawyers were in one room and Celtel executives in another. It just took two hours of reading and signing contracts for Merali to make Sh2 billion.

After buying 100 percent of Kencell in one room with Ibrahim’s money, Merali and his lawyers rushed across to the room where mandarins from Celtel were and offloaded the 80 percent stake for Sh25 billion…and still retained the 20 percent!

No other Kenyan had made Sh2 billion so casually! “The best time to buy is when foreign companies want to go, and the best time to sell is when they want to come,” he later told Forbes Africa.

In the ensuing eight years, Merali sold the remaining 20 percent: Dubai based Zain Group acquired a 15 percent stake for Sh5.3 billion in 2009 while India’s Bharti Airtel took the remaining five percent for Sh738 million three years later!

Merali also burnt his financial fingers too, losing Sh50 million in cut flower business

But Merali has been accused of selling companies which left new investors crying in the monetary toilet. He sold Equatorial Commercial Bank to Mwalimu Sacco for Sh2 billion. They rebranded it to Spire Bank-now in financial hell after Merali withdrew Sh1.7 billion days after offloading it!

That was not the first deal Merali was making super profits. In 2000, he bought 75 percent of East African Cables for Sh105 million from Britain’s Delta Electric who were leaving Kenya. Merali later sold the stake to Trans Century for 230 million in 2004, making Sh127 million profit!

Merali also bought Sasini from a stranger during a flight to London in May 1989. The stranger was the chair of Mercanta which owned Sasini and was shopping for a buyer. Merali bought 43 percent stake in Sasini for Sh1.5 billion-without seeing it or having background in agriculture. Sasini sits on 12, 000 acres in Kiambu County where an acres goes for over Sh30 million. Do the math!

Such is the story of Naushad Merali whose great-grandfather came from India and settled in Lamu in 1889. The husband of Zarina and father of Sameer and Jasmin Merali, was 70.